Con las últimas actualizaciones en las listas de precios de las marcas, hay cada vez más autos al borde de comenzar a pagar impuestos internos: el mal llamado “impuesto al lujo”, que en la práctica afecta a cada vez más productos de gama media ( ver decreto ).

La estrategia de las marcas es solapar cada vez a más modelos en el límite de dos millones de pesos: es el valor de venta al público a partir del cual comienza a tributar la primera escala de impuestos internos. Esta frontera no es exacta: algunas marcas logran estirar un poco ese límite, jugando con la comisión de los concesionarios. Es porque la base imponible se calcula antes de comisiones (y no después).

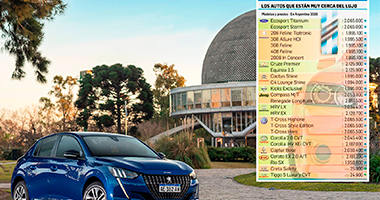

El diario Ámbito Financiero publicó hoy la lista de todos los modelos que hoy están al borde de pagar impuestos internos en la Argentina. Allí se incluyen varios vehículos de producción nacional: Peugeot 208, 308, 408, Citroën C4 Lounge y Chevrolet Cruze. La Toyota SW4 fabricada en Zárate hace tiempo que tributa este gravamen y sus precios distorsionados por la carga impositiva superan los cuatro millones de pesos, incluso en las versiones “de entrada a gama”.

Las pick-ups están exentas desde siempre, por tratarse de “vehículos comerciales”, destinados al trabajo.

En la práctica, es casi imposible conseguir estos modelos a precio de lista. Para eludir el impuesto, hay concesionarios que cobran importantes sobreprecios por fuera del valor oficial. Cómo actuar en caso de sobreprecios, en esta nota.

***

Nota del diario

Ámbito Financiero

Por la suba del dólar, más autos están al límite de pagar el impuesto “al lujo”

Por Horacio Alonso

En un mercado ultra dolarizado como el automotor, la suba del tipo de cambio trae consecuencias. El principal impacto es el aumento de los precios más allá de que estos se fijen en pesos. Con 70% de la oferta de vehículos importada, cualquier salto de la divisa estadounidense se refleja en las listas de las concesionarias.

Si bien esta situación afecta a todos por igual, hay un segmento de los 0 km que lo sufren de manera especial. Es el pelotón de modelos que rondan los $2.000.000 porque están al límite de comenzar a pagar impuestos Internos.

Desde el 1 de septiembre se actualizó la base imponible de la primera escala de este tributo para llevarla a $1.451.300 de valor de salida de fábrica o de distribuidor importado. Con la aplicación del IVA más el margen comisional, el precio al público de los vehículos que deben pagar se ubica ligeramente por arriba de esos 2 millones. No hay un valor exacto porque depende de la forma de cálculo y la posibilidad de resignar parte de la rentabilidad.

En caso de traspasar ese umbral, el vehículo debe comenzar a pagar una alícuota de 20% de esta nueva carga -considerada como impuesto “al lujo”- pero, por las características de implementación, implica una suba de precio del 25%. Este incremento hace que el vehículo afectado quede fuera del mercado al no haber compradores que convaliden ese aumento. Las empresas tratan de sostener sus autos por debajo de la base imponible para no ser castigados con mayor presión fiscal.

Eso es lo que sucede hoy con muchos modelos que están “topeados” en un valor que ronda los 2 millones de pesos. Este es un término que se utiliza en el sector para definir a los modelos que no son aumentados para evitar ser considerado un auto “de lujo” cuando, en realidad, se trata de vehículos de segmentos medianos o hasta chico. La suba del dólar empuja los precios para arriba y, para evitar pagar ese tributo, las empresas resignan rentabilidad (en algunos casos que venden sin ganancia) o, directamente, quitan de la oferta los modelos que no pueden seguir sosteniendo sin aumento. Según un relevamiento de Ámbito hay al menos unos 30 modelos que están en el límite de pagar el impuesto.

El ajuste de la base imponible se hace trimestral en base a un índice de precios mayoristas de 0 km. En el ajuste de septiembre se aplicó un incremento de 6.42%. El próximo ajuste se realizará en diciembre. El problema es que, desde esa última actualización, el dólar subió alrededor de 6%, es decir ya compensó ese incremento y todavía queda un mes y medio para un nuevo reajuste. Además, en el sector aseguran que la última modificación no reconoció la suba de los precios de meses previos, cuando el Gobierno modificó la forma de cálculo y “salteó” un ajuste.

Si en un modelo cualquiera, el 54% de su valor son impuestos, en los que pagan Internos ese porcentaje supera el 60%. A esto se suma que cada vez grava a vehículos de menor precio mostrando claramente que no son vehículos de alta gama. A comienzos de septiembre, la primera escala alcanzaba a modelos de unos u$s26.200 mientras que hoy afecta a partir de 0 km e u$s24.600. A este ritmo, cuando se llegue a final de noviembre, con un dólar que sigue subiendo, ese piso puede ser perforado en un par de miles de dólares, alcanzando a 0 km de segmento chico.

De hecho, Ámbito publicó hace dos semanas que ya no quedaban prácticamente modelos de menos de un millón de pesos. Los más económicos ya superan ese valor pero, según la base imponible de Internos, a partir de 2 millones, ya son considerados “de lujo”, lo que muestra un achatamiento inédito en la escala de precios.

Fuente:

Autoblog